Ethereum is expanding its role towards being a neutral settlement layer. Its value is being accumulated through L2 solutions and applications rather than by reducing L1 fees. Paradoxically, Ethereum seems to be both winning and losing from the perspectives of usage and income.

考虑一下:

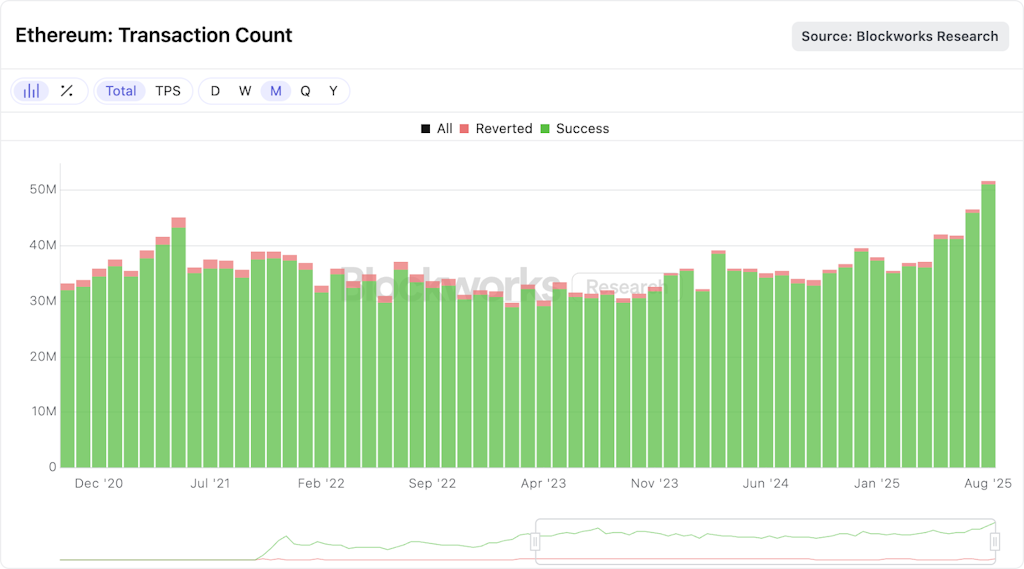

吞吐量上升:每月交易量和唯一活跃地址处于或接近高位。降低成本:中位数和平均交易费用接近周期低点;基本费用 gwei 较低且稳定。混合移位:Rollups 正在以创纪录的水平填充 blob;用户交易更多,尤其是稳定币,而没有推高 L1 费用。收入下降:基本费用消耗+小费远低于2021-22年;净发行量较低,但总体呈正增长。含义:价值源于对以太坊可信的中立性、安全性和跨 L2 结算的需求,而不是最大化 L1 费用。

1. 交易笔数:稳步攀升至新高(每月约 5000 万笔以上)。即使是撤销的交易也呈下降趋势,现在几乎不占任何比例,这表明市场更加健康。内存池 和 微型电动汽车動態。